In other words, if you send the required preliminary notices within the time they need to be sent, then you are protected — and that includes any withheld funds. It appears that the laws on retainage and the laws on mechanic’s lien rights were written in 2 different universes and 2 different eras. Simply put, these 2 sets of laws could not be any more contradictory. In fact, in some states, retainage isn’t a choice — that is, withholding money on state/county public works projects is sometimes actually required.

Account for retainage to track & recover payment

For example, the G702 and G703 AIA-style documents include sections that prompt you to determine the actual amount that you receive minus retainage. Recording and tracking retainage can seem confusing at first, but here’s a quick breakdown of what you need to know. Here are some forms and legal notices you may need to stay ahead on retainage. The steps required in a project’s journey to completion https://www.bookstime.com/articles/accounting are importation to how successful the project will be. At the end of the day, there’s really just one reason why a business — any business — fails. As anyone reading this surely knows, the construction industry loves its documents!

What Is a Work in Progress Schedule? Construction Accounting

When not reimbursed quickly, these withheld funds can create cash flow problems and affect a construction company’s profitability. Accounting for retainage payables typically involves tracking funds held back from contractors, subs, and suppliers until a project is finished. Just like the steps for recording and tracking retainage receivables, an account for retainage payables should be created in your company’s Chart of Accounts to monitor these transactions and balances. You can’t accurately manage retainage payables without good record-keeping. With a solid process in hand, you’ll not only be able to track the numbers correctly but will keep your company in compliance with Generally Accepted Accounting Principles (GAAP). Having competent accounting software in your business toolkit can significantly improve how you handle retainage contracts.

What does retainage mean in construction?

- Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post.

- To better confront the impacts of retainage on your construction businessYou must be diligent with your contracts, become familiar with state laws, plan for cash flow needs, and consider financing options.

- On the other side, subcontractors and suppliers are often made to wait until project completion or final approval to see their retainage payment, even if their portion of the project was finished early on.

- Achieving profitability in the construction business can sometimes be more of a challenge than the work itself.

- To protect your business, it is in your best interest to require that funds be released upon project completion, if not earlier.

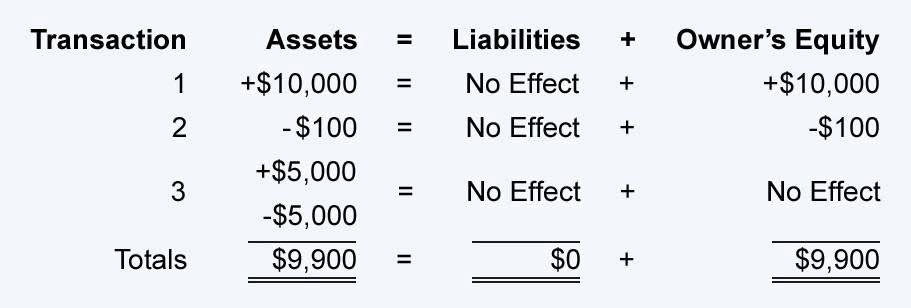

ABC Contractor is billing a project owner for $100,000 with 10% retention. The invoice is recorded in the chart of accounts with a credit to the income account for $100,000, a debit of $90,000 to accounts receivable, and a debit of $10,000 to retention receivable. Because https://x.com/BooksTimeInc retention is withheld from each payment and paid at a later date, the unpaid funds have to be recorded and tracked accurately. It can significantly impact the financial standing of contractors, especially when working on projects with a small profit margin. Failing to properly account for (or follow up to collect) 5-10% of the contract price can spell financial disaster.

How to record construction retainage

For example, a construction company records income and expenses throughout the project’s life, even if the customer hasn’t paid a progress bill. For example, a cash-basis construction company records income upon receiving retainage accounting payment from a customer. Likewise, the company records expenses when paying for tools or raw materials.

The Ultimate Guide to Construction Retainage

It’s important to note that retainage practices can vary based on local laws, industry standards, and specific contract terms. Always refer to the contract and relevant regulations to ensure correct calculation and compliance. You can also look into subcontractor performance bonds or retainage bonds as a unique alternative to traditional retainage. Subcontractor performance bonds are a special agreement between a subcontractor and a surety. In this agreement, the surety guarantees to complete the project in place of a subcontractor should the subcontractor fail to meet contractual obligations.